Your personal search profile

Receive the real estate offers you are looking for before they are even on the market.

Date

17.3.2022

Share

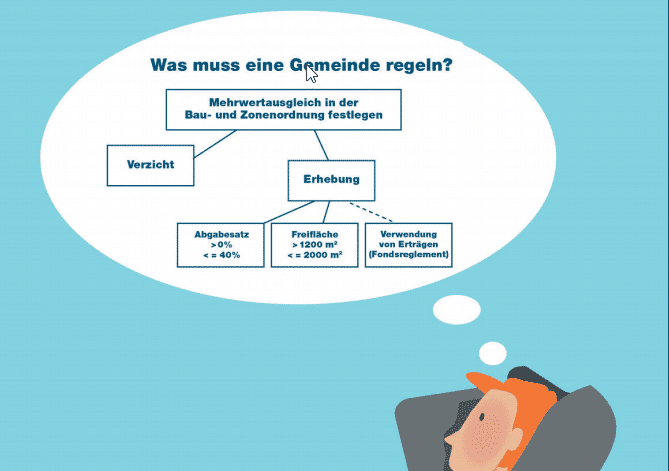

Anyone who deals with this topic cannot avoid the terms MAG and MAV. These are the two new regulations that have come into force. The MAG is the cantonal law on value-added compensation, which stipulates that 20% of the added value is payable as a levy at communal level in the case of zoning. The MAV, the Value Added Compensation Ordinance, regulates the value added compensation for upzoning and rezoning at municipal level. This must be defined by the municipality in the BZO building regulations and approved by the canton. This value-added compensation may amount to a maximum of 40%. A hefty sum which, as expected, is to be fully utilized by the city of Zurich, for example. If a municipality waives the value-added compensation, this must also be included in the BZO by no later than 1. March 2025 are recorded. In any case, an amendment to the BZO must be voted on, and the corresponding municipal proposals will be put to the people in the next few years.

If you would like to take a closer look at this process, we recommend this explanatory video from the Canton of Zurich Building Department, which explains the complexity of the topic well, or the PDF at the end of this article:

The purpose of this article is merely to point out the direction of travel and to draw attention to the fact that a levy is being introduced here that will lead to significant difficulties in the construction of new living space, that will be passed on to tenants and buyers for obvious economic reasons and that will place high technical and time-related demands on the canton and municipalities. And one that can be effectively countered with the right decision at the ballot box.

Cantonal officials use a computer-based platform to determine the added value with a value-added forecast. A hedonic method in which individual adjustments can be made by the officials. The landowners can subsequently comment on this proposal. If the municipality, which is responsible for determining the added value, and the owner do not agree, a time-consuming procedure begins, which is fraught with high costs and legal hot air. The landowner can then request an appraisal from a pool of appraisers compiled by the canton, which he will pay for at his own expense. In each individual case, the appraiser is determined exclusively by the canton and the further process is then up to the municipalities. If there is still disagreement, the only option is to take legal action. And since there are still many uncertainties and all the boundaries still have to be explored in practice, the courts will have a lot of work to do. A development that must also be observed with a keen eye and which, in terms of trickiness and potential pitfalls, is similar to the difficulties of determining property gains tax, which is also regulated at municipal level and therefore often differently from municipality to municipality.

“Anyone who wants to prevent the value-added equalization from making urgently needed housing in the canton of Zurich significantly more expensive will have the opportunity to do so at the ballot box.”

The value-added compensation “earned” by the municipalities is transferred to a fund to finance spatial planning measures. This finances planning law measures through to expropriations and measures for the design of public spaces, which is of course irrelevant in terms of the origin of the money. This means that the money paid indirectly into this fund by builders of residential or commercial space can be used to design parks, green spaces or to create social infrastructure such as meeting places for young people or senior citizens or extracurricular facilities.

This cross-financing unnecessarily increases the construction costs of urgently needed space and a pass-through to rental and purchase prices is clearly to be expected. The final opportunity to minimize or prevent these levies now lies with the individual municipalities, which can waive them. All that remains is for each and every individual to get involved at local level and to take a close look at the specific compensations provided for in the respective proposals when voting on them.

PDF of the Building Directorate

” Value-added compensation explained in brief”

Current legal change: More protection for home buyers in the event of construction defects

Reading time: 4 min

Ginesta owner portal: transparency for your property

Reading time: 2 min

When the vacations begin for others, our team is running at full speed.

Reading time: 3 min

Ginesta supports Winterhilfe Switzerland

Reading time: 1 min

We inform you about suitable properties before they are publicly offered.

"*" indicates required fields

One of the many advantages

I already have an account. To the login

"*" indicates required fields

"*" indicates required fields