Your personal search profile

Receive the real estate offers you are looking for before they are even on the market.

Date

18.3.2017

Share

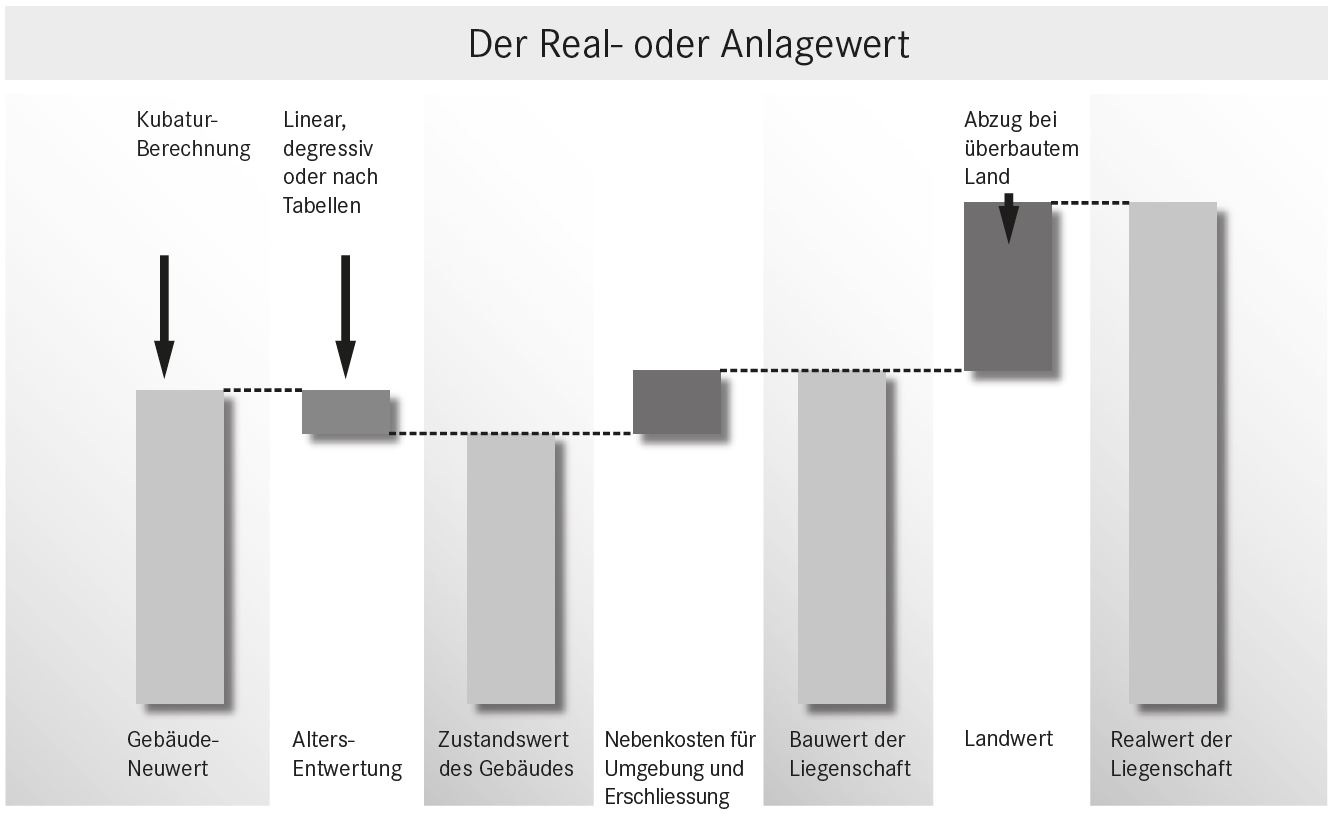

Market values for owner-occupied properties can be determined using various methods. The most common is the real value method, which takes into account three important core variables (see figure above): The condition value of the building, the ancillary costs for the development / surroundings / landscaping and the land value.

The starting point for a building value calculation is always the new value of the building, which is determined on the basis of the construction invoice or can be estimated using a volume calculation by multiplying the existing cubage by the construction price per m3 of enclosed space. If a property is no longer as good as new, an age deduction must be made from the new value of the building, depending on its current condition and the renovations carried out to date. Experience has shown that 0.5-1.0 % of the new value of the building can be deducted per year as a deduction for old age. In principle, the amount to be deducted as an age deduction is the amount required for structural measures to restore the building to as-new condition. Structural measures often create added value, which may not be taken into account as a deduction for old age.

The construction of a home requires an access road (development), supply and disposal lines as well as an appropriate garden and surrounding area. The costs incurred for this are usually in proportion to the construction costs, whereby around 10-20% of the construction costs should be expected, depending on the type of work carried out. The amount determined is added to the current value.

The land value is the third key figure that needs to be determined. Due to the topography and building regulations, very few properties in Switzerland have comparable conditions. For this reason, land value is the most difficult parameter to determine, although it is usually the most important. The real estate market is not transparent in large parts of Switzerland. Although changes in ownership of properties are publicized, sales prices are only published in a few cantons. When selling a property, the location is the most important characteristic. The following properties, among others, characterize or influence the quality of the location:

If similar properties in the same location have been sold in the past, comparative values can be used. Otherwise, historical data on the location, coupled with market trends, must be used. In most cases, the land value assessment can therefore only be carried out by an estate agent who deals with properties on site on an ongoing basis and therefore has the necessary local knowledge and market sensitivity.

Undeveloped but developed building land is used to calculate the land price. If a plot of land is already built on, a building development deduction is usually taken into account, as the buyer is restricted in his design due to the building. This also applies to undeveloped land, where development costs of CHF 100,300/m2 may have to be borne by the landowner, depending on the situation. In addition, the realization time frame for the construction of a house (e.g. possible objections, district planning procedures, etc.) also influences the value. An expert will of course carry out an appraisal to check whether the property is fully utilized with the existing house or whether there are reserves. Such an analysis can result in considerable appreciation or depreciation.

The market values of luxury properties are also determined using the real value method. Nevertheless, some differences should be duly noted:

Luxury properties are usually unique properties that contain a high degree of individuality and are often architecturally elaborate. This can lead to a massive increase in construction costs. While a construction price of CHF 600-750 per cubic meter of building volume is common for normal detached houses with a high standard of finishing, the cost per cubic meter for luxury properties can be well over CHF 1,000. Properties with sophisticated building services, indoor swimming pools, very expensive and exclusive surfaces or historically renovated buildings can even reach prices of up to CHF 1,500 per m3. It is also important to consider whether the basement and attic are insulated and finished, which can significantly increase the construction costs.

The more elaborate and exclusive a property is built, the higher the demands on the surroundings and the garden will be. Luxury properties are often situated in special locations with potentially difficult building land. In addition, an elaborate garden design will make the investment extremely expensive. The following are some features that are often associated with luxury properties and must be taken into account in the valuation:

Luxury properties are usually in good or even very good locations. The three most important features of an exclusive property are location, location and location again! In less good locations, it is not worth building a home that is too expensive. If the ratio of land value to house value is unfavorable, the property is considered difficult to sell. The land values of prime properties are often difficult to calculate. Especially when demand is high, collectors’ premiums are still paid for rarities.

The building laws in force in many cantons have resulted in more dense construction. Very often, old villas are demolished and replaced by new apartment buildings or condominiums. This trend can have both negative and positive effects on land prices. On the one hand, luxurious properties with lots of surrounding land will become more attractive as there are fewer and fewer of them. On the other hand, properties may also lose value if the entire surrounding area is redeveloped and an exclusive villa is suddenly located in the middle of a housing estate.

Land values are and remain very subjective key figures which, although they can be recorded statistically, always vary depending on the property and the specific situation. In contrast to building costs, land values react more flexibly to market requirements. It is up to the expert to examine the respective situation and estimate the land value to the best of their knowledge.

In principle, luxury properties must be valued individually, as there are rarely comparable properties. Each property therefore has its own advantages and specialties. Only an experienced expert who knows the regional market well can determine the potential market value.

In addition to the real value method described above, there are other valuation options for owner-occupied properties in practice. The best known are the comparative value method, the hedonic valuation model and the location class method. The comparative value method can be used if several residential units are identical and comparable, e.g. in larger residential complexes. The same applies to hedonic valuation models, which attempt to estimate the property value on the basis of traded comparative values. The location class method determines the land value in relation to the building value. Depending on the quality of the location, ratios are specified which should not be exceeded or undercut. The location class method is only used by experts, it is also considered rather controversial and is often only used for control purposes. In very exclusive locations, such as on both shores of Lake Zurich, in the Engadin, Gstaad or on the shores of Lake Geneva, the location class method is unsuitable.

Hedonic valuations are used by banks in Switzerland for initial control valuations. Depending on the valuation model, around 5 to a maximum of 20 property characteristics are entered into an electronic system, whereby the participating, credit-financing banks anonymize the property data of financed properties. Other providers only work with data from newspaper advertisements and the Internet (asking prices). However, such a procedure for determining possible “transaction values” is rather questionable in terms of accuracy. Basically, the key question with all comparative value methods is how the respective providers determine the land and property value when selling overbuilt properties or assume a ratio without knowing the exact terrain. Even the providers of hedonic valuation models specify that this valuation method is not suitable for collector’s and luxury properties due to a lack of sufficient comparable properties and that the results are therefore too imprecise.

Author: Claude Ginesta

Claude A. Ginesta is a federally certified real estate trustee and CEO / owner of Ginesta Immobilien AG. The company was founded in 1944 and specializes in the sale of real estate in the economic area of Zurich and Graubünden. With branches in Küsnacht, Horgen and Chur, the company acts as an estate agent throughout Switzerland for properties with a supra-regional character.

Publisher of the Illusions series: Ginesta Immobilien AG, www.ginesta.ch

Current legal change: More protection for home buyers in the event of construction defects

Reading time: 4 min

Ginesta owner portal: transparency for your property

Reading time: 2 min

When the vacations begin for others, our team is running at full speed.

Reading time: 3 min

Ginesta supports Winterhilfe Switzerland

Reading time: 1 min

We inform you about suitable properties before they are publicly offered.

"*" indicates required fields

One of the many advantages

I already have an account. To the login

"*" indicates required fields

"*" indicates required fields