Your personal search profile

Receive the real estate offers you are looking for before they are even on the market.

Date

26.3.2017

Share

Nowadays, investment properties (commercial properties / apartment buildings) are still traded on the basis of gross yields. However, the gross yield is a very imprecise measure of a property’s return. A gross yield often conceals various cost items, some of which are deliberately or mistakenly paid by the buyer or property owner. It is therefore worth carrying out a comprehensive review of a property before it is purchased. An owner should take a critical look at the current situation

As a first step, the costs of the property as a whole should be analyzed. A distinction must be made as to whether these are costs that are normally chargeable and payable by the tenant or whether they are general operating costs that must always be borne by the owner.

Heating, hot water preparation, hot water, cold water, waste water, janitor’s wages, general electricity, TV charges, service subscriptions for machines and lifts, lift operating costs, garbage charges and administration fees for any service charge settlement.

Operating costs such as insurance premiums, maintenance and repair costs, any rent and lease payments to third parties, energy supply and disposal, administration costs and loss of rent cannot be charged to the tenants and are always borne by the owner.

Although these facts are not new to property owners, major mistakes are often made when drawing up rental agreements. A cost analysis reveals the value creation potential of a property and identifies opportunities for improvement.

Here, the actual rents of the investment property should be compared with the market rents. The easiest way to do this is to determine the annual residential rent per m2 of net living space. Even if the rental income cannot currently be adjusted to a higher market level, there is often potential for optimizing income that can be exploited when tenants change.

Regularly planning or reviewing the investments required in the future is part of an owner’s or buyer’s job description. Although the ageing of a property cannot be stopped, it can be optimized with prudent renovation steps. For older properties in particular, it is advisable to draw up a 5 to 10-year investment plan and verify it on an ongoing basis. Although spreading the investments over several years is worthwhile from a tax perspective, comprehensive, one-off renovations of investment properties should not be disregarded because, from the landlord’s point of view, the costs can be passed on more optimally to the tenants in such a case or because certain types of work cannot be carried out at all if the tenants are using the property.

The next step is to determine the investment value, if this is not fixed in the form of a purchase price. An investment property can be assessed according to various valuation standards. Normally, a static capitalized earnings value method or a dynamic discounted cash flow (DCF) is used. Net asset value methods are also appropriate for control purposes, especially in prestigious locations with very high land prices (e.g. checking the possibility of conversion into condominiums).

Suitable capitalization rates must be defined for all methods. As a rule, it is very difficult for laypersons to determine the optimal capitalization rate. However, professional estimators must also exercise particular caution when selecting the capitalization factor. The estimator uses the current interest rate for a risk-free, long-term investment (e.g. federal bonds) as the base interest rate. A risk premium for real estate and a premium for administrative expenses, ancillary costs and vacancy provisions for renovations must also be defined. The experienced valuer can determine a definitive capitalization rate on the basis of these risk factors and many years of experience. If he wishes to provide transparent information about his considerations, he will present this capitalization rate or the derivation of the capitalization factor and openly disclose their value shares.

The net yield has nothing to do with net rental income. In principle, the net yield is calculated from the net rental income, reduced by all costs that are not paid by the tenant. This also includes mortgage interest costs. In a first step, an investor will calculate the net yield without borrowed capital, even if he later finances the property with mortgages. The “net return excluding interest on borrowed capital” calculated from this is known as the return on equity. It is therefore not diluted by financing costs. It is important for an owner of an investment property that the return on equity is higher than the interest on borrowed capital. This is the only way to optimize the return.

Replacing equity with low-interest debt capital increases the return on equity and creates a leverage effect. Due to the favorable interest rates, a net return without debt capital of around 4.5 % can certainly be increased to around 7 % to 8 % by means of favorable financing.

Every buyer or owner of an apartment building is recommended to conduct a thorough due diligence of the property in order to identify optimization opportunities and evaluate implementation steps. The aim is to optimize expenses by reducing costs and revenues by increasing income. The leverage effect should be examined and consistently exploited in line with the investment strategy and return expectations.

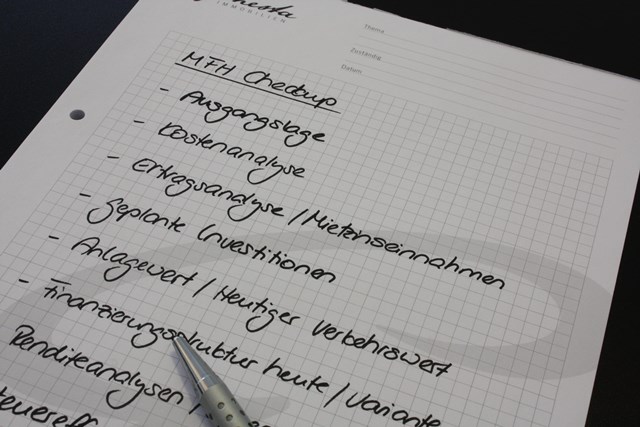

Every apartment building should occasionally be inspected by a real estate and management specialist. Ginesta Immobilien has developed a unique service for this purpose, in which a property is checked from various angles. An apartment building Check-UP is a fee-based service and usually involves 2 – 3 working sessions as well as a property inspection. It is primarily aimed at people who manage their property themselves, are no longer satisfied with the management company or are considering selling their property. The following examinations are associated with the multi-family house Check-UP:

1. Gross and net returns

2. Return on equity and leverage effects

3. Current market value

4. Current rents versus market rents

5. Analysis of operating and maintenance costs

6. Necessary planned investments

7. Tax effects for the property owner

8. Potential assessment

9. Action plan with summary of optimization options

Author: Claude Ginesta

Claude A. Ginesta is a federally certified real estate trustee and CEO / owner of Ginesta Immobilien AG. The company was founded in 1944 and specializes in the sale of real estate in the economic area of Zurich and Graubünden. With branches in Küsnacht, Horgen and Chur, the company acts as an estate agent throughout Switzerland for properties with a supra-regional character.

Publisher of the Illusions series: Ginesta Immobilien AG, www.ginesta.ch

Current legal change: More protection for home buyers in the event of construction defects

Reading time: 4 min

Ginesta owner portal: transparency for your property

Reading time: 2 min

When the vacations begin for others, our team is running at full speed.

Reading time: 3 min

Ginesta supports Winterhilfe Switzerland

Reading time: 1 min

We inform you about suitable properties before they are publicly offered.

"*" indicates required fields

One of the many advantages

I already have an account. To the login

"*" indicates required fields

"*" indicates required fields