The special circumstances challenge us all equally special these days. For us, it means keeping the business going and protecting our employees. To date, we have seen almost no withdrawals of buyers from reserved contracts and have been able to notarize the transactions regularly in recent days. However, the demand for viewings has declined in recent days due to the measures decreed by the Federal Council.

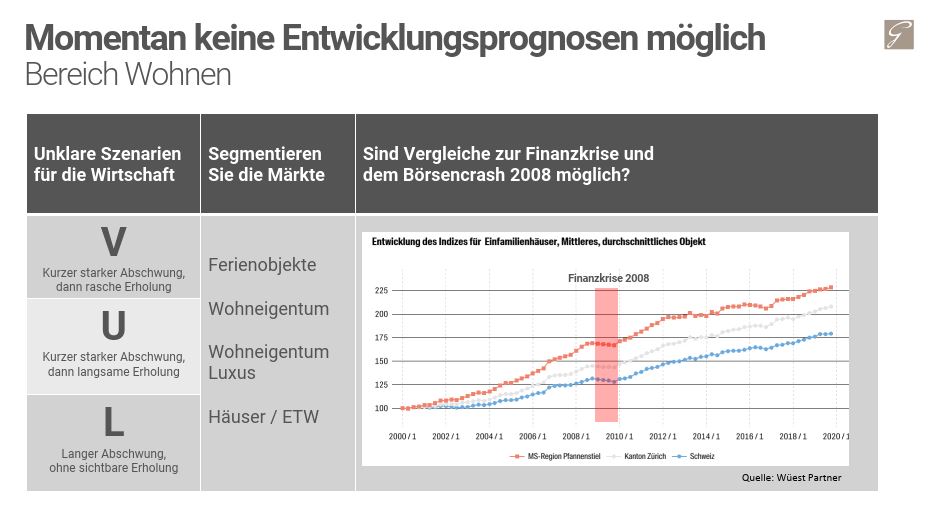

In 2008, we already experienced a stock market downturn of 30 percent, which we felt as a brokerage firm. Please allow us therefore to briefly outline our assessment of the current situation on the real estate market based on my experience to date:

Basically, the real estate market is based on the following four pillars:

1. robust economic situation/stock exchange

2. robust immigration

3. low interest rates

4. Good market psychology

Two and a half of these pillars are currently wavering:

- The stock market has lost almost 30%, individual shares even 50% in value: the profits of the last 2-5 years are therefore no longer available. However, investors with a longer investment horizon still have a good (and positive) overall performance of the last 10 years.

- Switzerland has had lower immigration for some years now, which is particularly noticeable in rural areas and in new construction projects. In the conurbation of Zurich, this decline has not yet had any impact.

- The current market psychology is negative. Analysts are forecasting an economic downturn, which is leading to a general reluctance to buy. In such turbulent phases of a possible economic downturn, there is usually a "mismatch": trading hardly takes place at all. In 2008, too, there were only a few changes of ownership following the stock market crash. Only when the stock market started to rise again did the real estate market regain momentum. This is how it could also happen in the near future.

Only in two to three months' time will we see more concretely whether the current crisis can be described as a temporary standstill or whether it will lead to a major economic crisis. Even a yo-yo effect with a greatly improved stock market and economic situation cannot be ruled out in early summer.

At this point in time (and in ignorance of further developments), we are still questioning a drastic economic downturn. That is why the majority of us do not recommend reducing property prices. The exceptions are properties that were already difficult to sell before the current crisis. Here, a price adjustment could stimulate the market. Should a persistent economic crisis indeed manifest itself, the "Survival of the fittest" competition will be launched. In this case, the seller who reduces the selling price the most will sell first. As a matter of principle, each individual object should be considered separately. If you would like to discuss individual strategies for selling your property, we are always at your disposal.

We are currently in the process of equipping many properties with virtual walkways so that you can gain a first impression in the next few weeks without having to visit the property on site. We believe that customers will appreciate this new type of property viewing in the times of Corona.

We wish you good health and hope that we will soon be heading for more positive times.

Have the charts as a download: