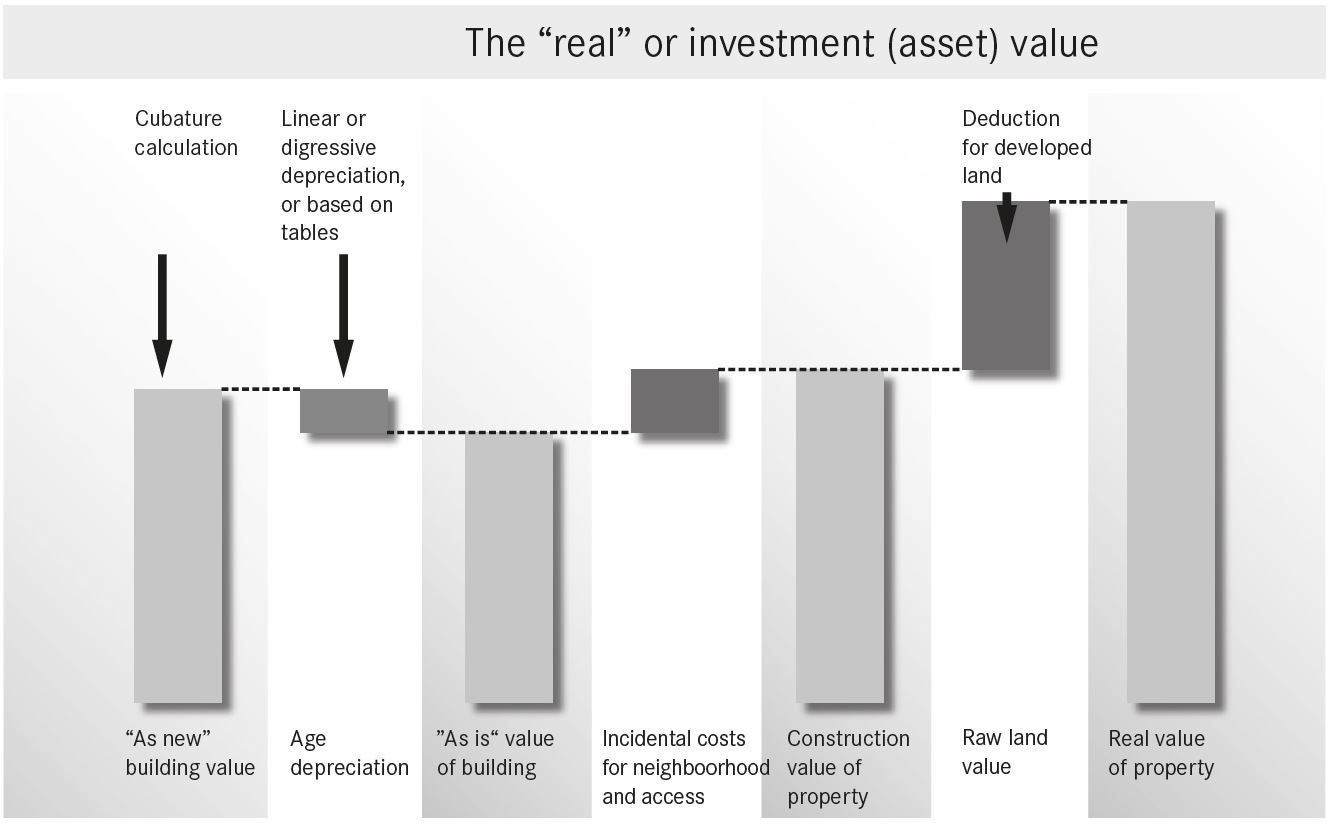

The fair market value of owner-occupied properties is determined by various methods. The most common is the real (effective) value method, which takes into account three important key data (see above graph): 1) the ”as is“ value of the improvements (building(s) and systems infrastructure); 2) the secondary costs for street access / neighborhood / landscape-garden design; and 3) raw land value.

The starting assumption of building value estimate is always the building‘s value ”as new.“ This is determined on the basis of a construction estimate, or is estimated using a volume calculation, in which the existing cubature is multiplied by the development price per cubic meter of improved space. If a property no longer has its ”as new“ value, a deduction for age depreciation (depending on current condition and any previously completed renovations) is subtracted from the ”as new“ value. Based on our experience, a per year 0.5 - 0.1% deduction from the ”as new“ value is a justifiable approach to age depreciation. In principle, the amount deducted as ”age depreciation“ is that amount required for construction purposes in order to restore the building to an as-new condition. Frequently, construction efforts create added value - however, this added value goes beyond what may be taken into account when calculating age depreciation.

The construction of an owner-occupied property requires ingress (entry access), supply and disposal services, as well as a commensurately-sized garden and turnaround radius. The costs incurred for this are often a ratio of the total construction costs. One can anticipate this figure to be 10 % - 20 % of construction costs, depending on the type of work involved. The established amount is added to the value of the property in its ”as is“ condition. The raw land value is the third key datum that must be determined. In Switzerland, due to topography and building codes, only a handful of properties possess comparable conditions. For this reason, raw land value is the most difficult figure to determine - although it is often the most important parameter. The real estate market lacks transparency in wide areas of Switzerland. Changes in title to (ownership of) real estate are indeed made public; however, the sales prices are published in only a few cantons. When selling real estate, property condition is the most important attribute. Among other things, the following criteria may indicate or have an influence on locational quality:

- Quality of the site (view, trees on neighboring properties, topography, geographic features, access, sun exposure, emissions)

- Potential uses (construction zoning, laws, private easements among neighbors)

- Transportation conditions (proximity to streets, schools, available shopping options)

If similar property was sold on the same lot in the past, then one can refer back to these transactions for ”comparable values.“ Otherwise, one must rely on historical data about the location, combined with market trends. For this reason, in many cases only a broker can establish the estimated value of the raw land, particularly a real estate professional who works with local properties consistently, and who therefore possesses the requisite local expertise and market knowledge.

Unimproved but connected development land is considered when calculating a land price. If a property has already been improved (developed), then a development deduction is taken into account, because the existing use of the improvements encumber the buyer. This also applies to unconnected land, where - depending on the situation - between CHF 100-300/m2 in access costs may be incurred by the land owner. Moreover, the realization timeframe (construction schedule) of a house may influence value (due to, for instance, required public hearings, meetings, or district planning procedures). As part of the appraisal process, the real estate professional will investigate if the land has been fully utilized with the existing house, or if a reserve of developable land still exists. As part of such an analysis, substantial accretions or depreciations in value may arise.

Additional factors in the valuation of luxury real estate

Even the market values of luxury properties are determined using the real value method. Nonetheless, a few differences should be given due attention:

Building‘s value as-new

Luxury real estate typically involves truly one-of-a-kind properties with an inherently high degree of individuality that, in view of their architectural pedigree, are often constructed at great expense. This could dramatically elevate the price of construction costs. While a con-struction value of CHF 600 - 750 per cubic meter of building volume may be typical of the standard high-grade single family house, the costs per cubic meter of luxury real estate may well exceed CHF 1,000. Properties with top-of-the-line home technologies, indoor pools, extravagant and exclusive finishes may even reach prices up to CHF 1,500 m3 - as can historic structures that have been renovated. Also taken into account: whether cellar and flooring are insulated and finished - which may substantially increase construction costs.

Incidental costs for access and neighborhood

The more expensive and exclusive the construction of a property, the greater the demands placed by the neighborhood (assessments) and on the garden (access to roads, utilities). Luxury properties are often situated in special locations with potentially difficult foundation soil (marginal land). In addition, an expensive garden design will increase

the investment costs considerably. The following are few property features that are often applicable to luxury real estate, and that have to be considered in the valuation:

Expensive building site

- Direct lakeside location (ground water)

- Vista on steep slope (solid rock)

- Location amidst historic city center (access to construction site)

Expensive garden features

- Special tree-lined alleys

- Expensive support and garden walls

- Outdoor swimming facilities

- Automatic watering systems

- Lighting

- Automated garden gates

Land values

As a rule, luxury real estate is situated in very good to even excellent locations. The three most important characteristics of an exclusive property are location, location and once again, location! It is not prudent to construct a costly owner-occupied house on a less attractive or blighted location. If the ratio of land value to house value (improvement ratio) is negative, then the property will be considered difficult to sell. Often, the land values of top properties are difficult to illustrate in mathematical terms. In particular, if demand is strong, the enthusiastic investor will typically pay additional amounts for rare features.

It is possible to achieve high-density construction under the building laws prevailing in many cantons. Frequently, an investor will purchase an old villa, partition the land and replace the improvements with new multi-family homes or condominium units. This trend can have negative as well as positive influences on land prices. On the one hand, if

there is a strong reversal trend, luxury real estate will gain in appeal as an ever fewer number of them remain available. On the other hand, real estate can also lose value if the surrounding neighborhood has been overdeveloped, leaving an exclusive villa suddenly sitting in the middle of a residential project.

Land values are and remain very subjective figures that are indeed compiled statistically; still, they constantly vary, depending on the property and specific circumstances.

Unlike construction costs, land values respond flexibly to market needs. It is up to the real estate professional to review the current situation and to determine land values

based on his or her best judgment and abilities. In principle, luxury real estate must be appraised individually, since comparable properties are rarely found. Each property therefore has its own advantages and special features. Only an experienced business professional who is well familiar with the regional market can determine potential market values with accuracy.

Additional appraisal models

In addition to the real value methods, there are other valuation possibilities for owner-occupied properties that are used in practice. The most familiar are the sales comparable methods, the hedonic price method and the locational rating method. The sales comparable method may be applied if multiple residential units are identical and comparable - thus, for example, in larger residential developments. The same applies to the hedonic price method, which attempts to appraise the property value based on transacted comparable values. The locational rating method determines land value as a ratio of building value. Ratio figures are indicated depending on the locational quality, which one should not exceed or fall short of. The locational rating method is only applied by real estate professionals. In addition, the method is considered controversial, and is often applied for control purposes only. The location rating method is unsuitable for completely exclusive locations, such as for properties on either

bank of Lake Zurich, in Engadin, Gstaad or on the banks of Lake Geneva.

Hedonic price valuations are applied in Switzerland by banks for initial control valuations. Depending on the appraisal model, roughly 5 to maximum 20 property characteristics are entered into an electronic system. The participating, loan-issuing banks anonymize the property data of financed real estate assets. Other providers only work with data from newspaper publications and the internet (offering prices). Such a process to determine the potential ”transaction values,“ however, is dubious with regard to their accuracy. Essentially, all comparison methods lead one core question: In the sale of developed properties, how do the respective suppliers determine land or property value? Or how do they assume a (comparative) relationship among them without precise knowledge of the site? Even the suppliers of the hedonic price valuation model themselves clearly state that these valuation methods are not suitable for architecturally distinct or luxury real estate due to the paucity of sufficient comparable property data, which lead to highly imprecise value conclusions.

Author: Claude Ginesta

Claude A. Ginesta is a federally licensed real estate fiduciary (registered with the SVIT, the Swiss Federation of Real Estate Fiduciaries) and owner and CEO of Ginesta Real Estate AG.

The company was founded in 1944 and specializes in the sale of properties in the Zurich and Grisons markets. With offices in Küsnacht, Horgen and Chur, the company operates as real estate broker throughout Switzerland for properties located across the country.

Publisher of the “Illusions” series: Ginesta Real Estate AG, www.ginesta.ch