Current market situation in the USA

In 2022 and 2023, the US property market was shaken by sharp increases in mortgage interest rates. These rose to an alarming 8% at times, leading to a significant cooling of the market. Certain regions were particularly affected, with trading volumes falling by 30-50%.

Another indicator of market tensions is the «Housing Affordability Index», which shows what percentage of income has to be spent on housing costs. In some markets, such as Denver with 40%, Orlando with 35% and Phoenix with 33%, this index has reached alarming levels, exceeding the critical value of 33%.

The drastic decline in buyers from the millennial generation is particularly alarming, falling from 43% in the previous year to 28% in 2023. This decline is mainly due to the low equity of this age group, which makes it increasingly difficult for them to afford property. In contrast, baby boomers currently represent the largest group of buyers with a share of 39%. The need to compromise when looking for a property has become a reality for many buyers: 62% have to stretch their budget, 51% are focusing on smaller homes and 28% are forced to expand their search radius. These developments underline the growing challenges in the property market.

At the moment, however, there are signs of a slight easing: both inflation and interest rates are falling, with mortgage rates currently at 6.9%. Forecasts by major mortgage banks such as Fannie Mae, the Mortgage Bankers Association and Wells Fargo point to a further reduction in mortgages to between 5.5% and 6.1% by the end of 2024.

Exclusive insights:

Two outstanding property projects in New York

During our recent trip to New York, we had the privilege of visiting two exceptional property projects that stand out for their uniqueness and luxury features. The tours, made possible by the renowned real estate agency Corcoran, gave us a deep insight into the world of high-end property in the heart of New York.

On High Line: Living in luxury

The first project, «On High Line», is a breathtaking development in Chelsea Hudson Yards that sets new standards with its location and amenities. With 236 residences and a market value of over USD 1.4 billion, this project represents the pinnacle of urban luxury living. The price range for the flats is equally impressive, with the most expensive units changing hands for over USD 17.5 million. Even a parking space in this prestigious development is a statement of luxury at USD 750,000. The estate agent who showed us around the complex is one of the top agents in the USA, with property sales of over USD 500 million last year alone - a testament to the exclusivity and sought-after location of «On High Line».

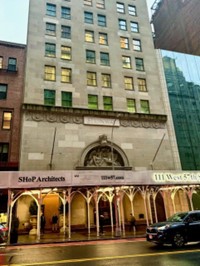

111 West 57th Street: An architectural masterpiece

The second project, 111 West 57th Street, is an architectural marvel characterised by its slender silhouette and extraordinary height. At 435 metres, this skyscraper is not only one of the tallest, but also one of the narrowest buildings in the world. The residences, each occupying an entire floor, offer unrivalled luxury and privacy in this hectic metropolis. The maisonette we visited on the 57th floor, with a floor area of 605 square metres, was advertised at a price of USD 54.6 million. Interestingly, there are no parking spaces in this

building, which underlines the expectation that residents are likely to have a personal chauffeur. The monthly maintenance costs of USD 17,000, plus an equally high sum for

property taxes, emphasise the financial commitment that comes with such luxury.

The buyers of these exquisite residences are mainly made up of people who have these flats as their third, fourth or even fifth home. These international buyers often own properties in the most exclusive areas such as the Hamptons, Florida and Aspen and see their New York flat as another jewel in their collection of luxury homes. The transactions are usually done in cash, which emphasises the financial strength of this group of buyers.

Unfortunately, the weather didn't play ball during our visit and we were denied the famous view of Central Park. Nevertheless, the experience was extremely enjoyable and impressive, even for those of us with a fear of heights.

These tours not only gave us a rare insight into two of New York's most spectacular property projects, but also a deeper understanding of the dynamics and exclusivity of the high-end property market in this vibrant city.

Upheaval in the US property sector: a wake-up call for the market

Recently, the US property industry has experienced a number of challenges that have far-reaching implications for agents, buyers and the industry as a whole. In addition to the

already high interest rates that are significantly impacting the market, class action lawsuits filed by buyers against brokerage firms have caused a stir. Buyers are complaining about uniformly high commissions that have to be paid to estate agents, even if they are not sufficiently familiar with the properties in question. This problem is very reminiscent of the discussions in Germany, where the "buyer pays principle" in the rental market has led to the estate agent costs having to be borne in full by the commissioning party, i.e. usually the landlord.

Large brokerage companies such as RE/MAX, Anywhere and Keller Williams were forced to pay large fines to get out of these legal disputes. The class action plaintiffs argued that commissions were constantly kept high and price fixing was taking place between market participants.

Another controversial topic is the aggressive expansion of CoStar, a giant among private equity companies that is buying up more and more property portals. Compared to CoStar, even Immoscout.de or the Swiss Marketplace Group are small players. CoStar already held a significant position in the commercial property sector before the acquisition of platforms such as Homesnap, flats.com and Homes.com. The new acquisitions in the USA and marketplaces purchased in Europe (e.g. onthemarket.com in the UK) are now targeting the global residential property market with the clear aim of becoming the market leader. To this end, annual advertising expenditure of USD 600 million is being invested in the USA for the growth of Homes.com. By comparison, Zillow's advertising budget is estimated at USD 150 million. In the third quarter of 2023, Zillow had over USD 3.2 billion in cash reserves, compared to CoStar's over USD 5 billion.

What distinguishes CoStar from Zillow is its B2B strategy. CoStar offers detailed data and analyses for agents, while Zillow, as a marketplace with a B2C strategy, focuses on property listings and tools for searchers/buyers. For estate agents, the Homes.com portal (from CoStar), for example, offers the promise «Your listing, your lead», which means that estate agents are at the forefront and receive the leads directly without having to buy them by auctioning them off to the highest bidder - a constant practice at Zillow or Immoscout.de These developments in the US property sector signal a significant shift. The threatening gestures of the supposed "white knights" SMG that Facebook or Google would soon take over the property trade are not heard in the USA. However, it seems clear that small estate agent companies without a brand will be lost in this competition between the giants. It is therefore not surprising that large franchise companies and listed companies such as RE/MAX, Keller Willams Reality, Coldwell Banker, Berkshire Hathaway HomeServces, Anywhere Real Estate and Compass Group have bought up small estate agent companies in recent years or have disappeared altogether.

Artificial intelligence:

a paradigm shift in the digital world

Artificial intelligence (AI) was at the centre of discussions at the Inman Connect NYC conference, but the reality behind the hype left us somewhat disillusioned. The complexity

and opacity of AI algorithms, even for developers, presents a remarkable challenge. It's an ironic twist that the creators of these technologies often can't fully explain how their

algorithms arrive at their results.

AI has long since expanded beyond text-based applications into the world of photography and videography. Numerous useful tools were presented that show how far AI has already progressed in these graphical areas. This illustrates that AI is more than just ChatGPT; it is a comprehensive ecosystem that permeates all aspects of our digital lives.

The use of algorithms is now ubiquitous on platforms such as X (formerly known as Twitter), Instagram, Snapchat, Facebook, TikTok and YouTube. YouTube in particular is currently promoting longer video formats, which can often be interrupted by (paid) adverts, while shorter content of less than 60 seconds does not perform as well as longer videos, which should ideally be between 1-3 minutes, with a tendency towards even longer formats.

The primary goal of these algorithms is to keep users on the platform for longer by providing them with relevant content. Ultimately, the platforms aim to become the dominant force in the digital space by maximising content and user numbers. This business goal drives the constant adaptation of algorithms to attract and retain user attention in an increasingly flooded digital landscape.

The ChatGPT revolution:

a turning point for the world of work

On stage at the Inman Connect NYC conference were representatives from OpenAI who shared a fascinating insight into the future of work. Claiming that ChatGPT will change 60% of jobs, they made it clear that we are only at the beginning of a far-reaching development. This insight is particularly relevant for brokers and entrepreneurs who are striving for efficiency and improving their customer relationships in an increasingly digitalised environment.

The use of ChatGPT and similar AI tools promises to revolutionise the way we work by automating repetitive and time-consuming tasks. This opens up new opportunities to take

care of customer concerns in a more intensive and personalised way - an approach that has already been pursued in the past through marketing automation. Digital automation is now expected to reach a new dimension with the help of AI tools.

In one notable session, a broker advised personalising the system through targeted training by asking ChatGPT specific questions about their business. It was suggested to define buyer and seller personas with their specific needs and pain points in order to develop a targeted, AI-based profile. Interestingly, it was noted that ChatGPT could be challenged by adopting a specific, firm tone when answers were unsatisfactory, or even emphasising how important the answer was to their job in order to potentially get the information they wanted on the third attempt.

One area that still raises questions is the use of the data entered in the context of open source projects. Concerns regarding data protection and data security are particularly

relevant in this context. One sensational case is the lawsuit filed by the New York Times against ChatGPT, which relates to the possible use of protected content from the newspaper's archives. Other publishers, however, such as Axel Springer, have decided to release their archives for use in return for payment.

Another critical issue is the spread of fake news through AI. The system's ability to store and process false information raises important questions regarding the reliability and

trustworthiness of AI-generated content. The implications of ChatGPT and similar AI technologies for the world of work are profound and complex. Whilst they offer huge opportunities for increased efficiency and customer service, the ethical, legal and security aspects need to be carefully considered. We are at the

beginning of a revolution that will permanently change the way we work.