„The three most important criteria in evaluating a property are location, location, location.“ But in reality, things are not quite that simple. In the following, we explain the other criteria that add to a property‘s appeal, and the methods of valuation used in the appraisal of a property.

Differentiation of location quality criteria

- Macrolocation

„Macrolocation“ refers to the quality of a region and the community. Similarly, the tax situation requires consideration, because it is very significant to real estate value and has a strong influence on land prices. Also, the distance from cities and from urban agglomerations are decisive criteria for what a buyer is willing to pay for a property, as well as transportation access.

- Microlocation

„Microlocation“ refers to the circumstances within the property‘s district. Microlocation entails the property‘s orientation, sun exposure, and view, as well as emissions - such as the proximity to a rail line, for example, or a street. Any property should be inspected at various times of the day, so that you can exclude any emissions exposure, or assess their impact. Furthermore, you need to carefully inspect the property record in the land registry in order to understand the easements, liens and any judgments on title. A visit to the offices of the local building authority, and a careful review the building codes, are indispensible. Location is not quite location. When determining a price, an individual buyer will proceed differently than an investor. There are differences between absolute and relative land values.

- Absolute land value

„Absolute land value“ pertains to the property in terms of comparative values. For example, the analysis draws on sales transaction data on neighboring real estate. This basic principle applies: „Under ordinary, average circumstances, what would one pay for such a property?“ However, one must exercise caution on a case-by case basis. Specifically, certain properties may prove to have a number of possible uses; in addition, easements may exist on the title to the property being appraised that could restrict construction / development options - and thus influence the land value.

- Relative land value

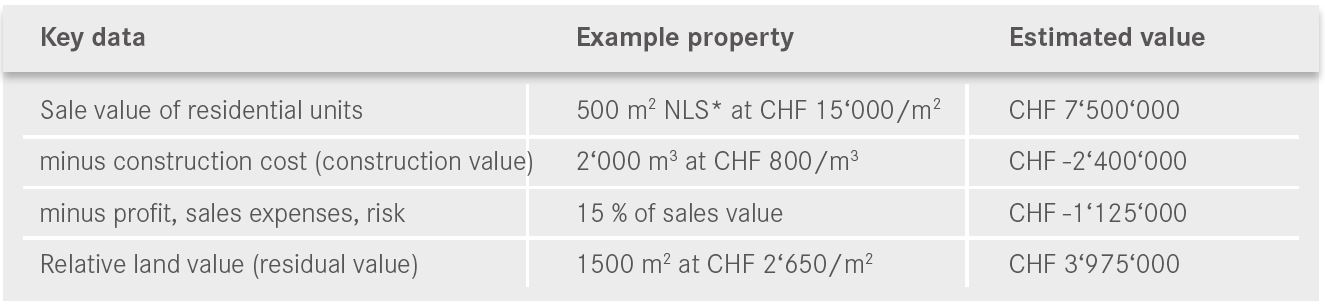

„Relative land value“ expresses the land value in relation to its development potential. Land value is calculated using complex valuation processes that can only be applied by certified real estate professionals. In this regard, this also includes a „reverse calculation,“ which can be illustrated by the following (highly simplified) computation:

Real estate tip: Find the balance between the quality of the location and the property

The land value usually equals between 20% and 50% of the fair market value of a property. As a rule, one can build more extravagantly on valuable land than on cheap land. When reselling, one must specifically pay attention to the fact that an unfavorable ratio of land to construction values may cause problems. Failure to take heed of these rules makes it highly likely that the market will eventually no longer be able to absorb the investment costs. Therefore, consulting the investment with a real estate professional in advance will prove invaluable. It is also prudent to adapt the construction budget to the quality of the location.

Author: Claude Ginesta

Claude A. Ginesta is a federally licensed real estate fiduciary (registered with the SVIT, the Swiss Federation of Real Estate Fiduciaries) and owner and CEO of Ginesta Real Estate AG.

The company was founded in 1944 and specializes in the sale of properties in the Zurich and Grisons markets. With offices in Küsnacht, Horgen and Chur, the company operates as real estate broker throughout Switzerland for properties located across the country.

Publisher of the “Illusions” series: Ginesta Real Estate AG, www.ginesta.ch